AML

Apt-AML

- Project Name: Apt-AML (Anti Money Laundering)

- Category: Banking

- Start Date: 25-jan-2017

- Status: Complete

- Project Ranking:

Anti Money Laundering

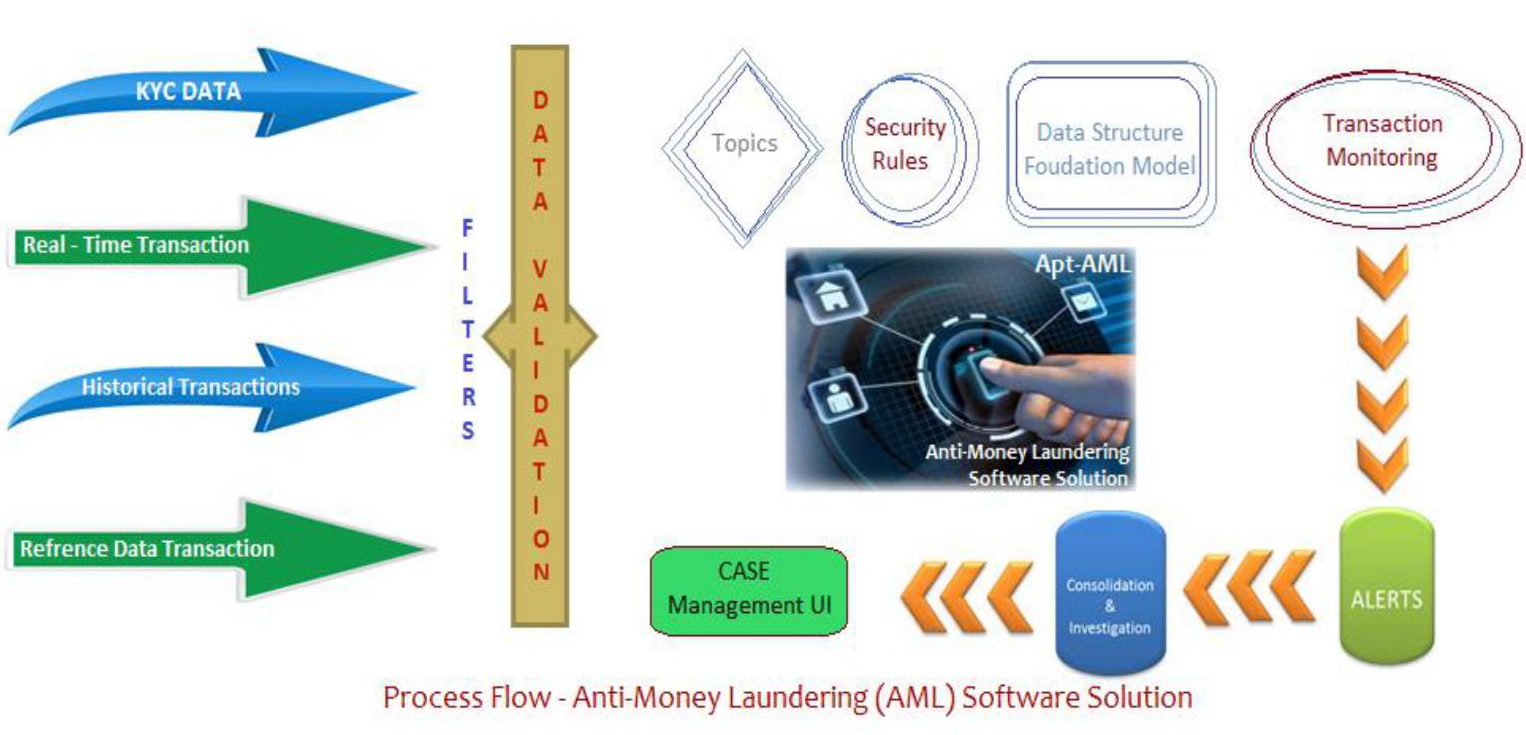

Anti-money laundering guidelines came into prominence globally after the September 11, 2001 attacks and the subsequent enactment of the USA PATRIOT Act in the United States and the establishment of the Financial Action Task Force on Money Laundering (FATF). By 2010 many jurisdictions globally required financial institutions to monitor, investigate and report transactions of a suspicious nature to the financial intelligence unit in their respective country.

An entire industry developed around providing software to analyze transactions in an attempt to identify transactions or patterns of transactions, called structuring, which requires a SAR filing, or other suspicious patterns that qualify for SAR reporting. Financial institutions faced penalties for failing to properly file CTR and SAR reports, including heavy fines and regulatory restrictions, even to the point of charter revocation.

There are four basic types of software addressing AML business requirements:

Transaction monitoring systems, which focus on identification of suspicious patterns of transactions which may result in the filing of Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs). Identification of suspicious (as opposed to normal) transactions is part of the KYC requirements.

Currency Transaction Reporting (CTR) systems, which deal with large cash transaction reporting requirements In India.

Customer identity management systems which check various negative lists (such as OFAC) and represent an initial and on-going part of know your customer (KYC) requirements. Electronic verification can also check against other databases to provide positive confirmation of ID such as (in the UK: electoral roll; the "share" database used by banks and credit agencies; telephone lists; electricity supplier lists; post office delivery database.

Compliance software to help firms comply with AML regulatory requirements; retain the necessary evidence of compliance; and deliver and record appropriate training of relevant staff. In addition, it should have audit trails of compliance officers activities in particular pertaining to the handling of alerts raised against customer activity.

Objective

With ease of Suspect Search & Know your customer features, it helps banks and financial institution to keep a tight watch on people involved in Money Laundering activities. The Anti-Money Laundering (AML) software solution integrated AML lifecycle management while delivering insight across the customer lifecycle ensures smart and efficient AML operations for a positive, holistic customer experience.Screening

- Transaction Monitoring

- KYC (Know Your Customer

- Regulatory Reports

SCREENING

- Screening against UNSC Sanctions lists & Custom lists provided by regulatory bodies like

- Screening incremental or full customer base against UNSC Sanctions list.

- Whitelisting of trusted customer and blacklisting of suspicious customer.

- Event Generation and Management based on Screening.

Transaction Monitoring

- Transaction Monitoring as per International (FATF) and RBI guid

elines.

- Pre-configured business rules.

- Business rule manager for managing the rules.

Know Your Customer

- Validate customer against UNSC Sanctions lists & Custom lists.

- Identify suspicious transactions or unobvious activities.

- Customer Risk categorization as per RBI guidelines.

- Single view of Customer's all interconnected accounts.

- Integrated Customer view with Account and Transactions.

Regulatory Reports

- Readily available Regulatory reports like CTR, NTR, STR, CCR, CB

WT & Walk In customer Report.

- Administrative reporting to track user activities.

- Full Audit report of all critical activities.

elines.

WT & Walk In customer Report.