PACS

APT-PACS

- Project Name: APT-PACS

- Category: Banking

- Start Date: 25-jan-2017

- Status: Complete

- Project Ranking:

Primary Agricultural Credit Society (PACS)

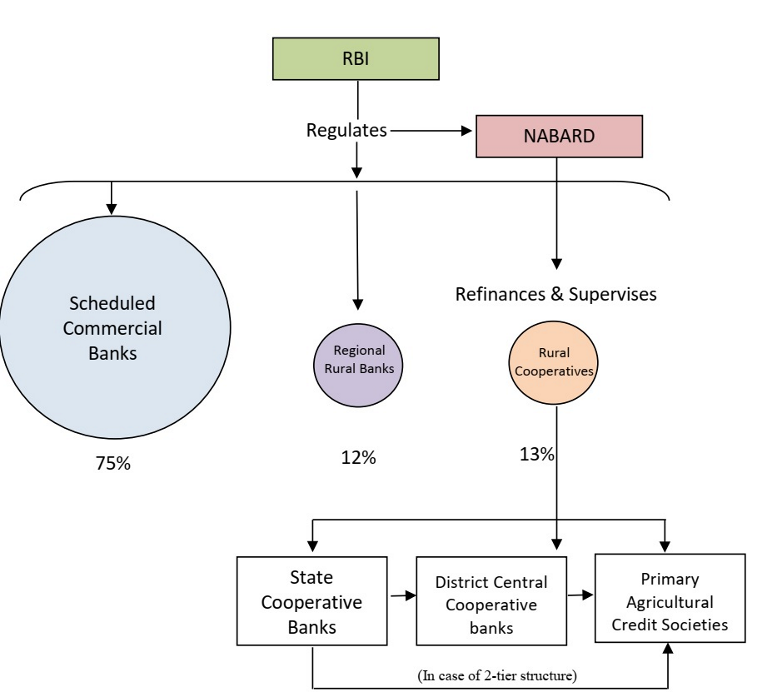

A Primary Agricultural Credit Society (PACS) is a basic unit and smallest co-operative credit institutions in India. It works on the grassroots level (gram panchayat and village level).The rural co-operative credit system in India is primarily mandated to ensure flow of credit to the agriculture sector. It comprises short-term and longterm co-operative credit structures. The short-term co-operative credit structure operates with a three-tier system - Primary Agricultural Credit Societies (PACS) at the village level, Central Cooperative Banks (CCBs) at the district level and State Cooperative Banks (STCBs) at the State level.

PACS are outside the purview of the Banking Regulation Act, 1949 and hence not regulated by the Reserve Bank of India. STCBs/DCCBs are registered under the provisions of State Cooperative Societies Act of the State concerned and are regulated by the Reserve Bank. Powers have been delegated to National Bank for Agricultural and Rural Development (NABARD) under Sec 35 (6) of the Banking Regulation Act (As Applicable to Cooperative Societies) to conduct inspection of State and Central Cooperative Banks.

Activities of PACS:

- Short Term Loans to members.

- Accepting Savings and deposits from members.

- Running PDS Shops.

- Selling Agriculture Inputs.

- Running Janta Bazar.